Equitability

Equitability refers to the principle of fairness in the social and economic relations embedded in a product’s value chain. The notion of fairness is deeply rooted in our culture, and the application of this value in a business context implies that companies are obliged to ensure, as far as this is possible, the fair treatment of every person connected with the value chains of their products. This responsibility applies to the physical and mental well-being of both employees and, especially relevant in the case of the wine industry, consumers, as well as to the general fostering of equitable relationships between the various actors in the specific industry, whether suppliers, customers, or competitors.

Equitability is often discussed in the context of the social dimension of sustainability. This inclusion is based on the assumption that social inequalities, like environmental imbalances, cause instabilities in socio-economic systems that in the long term threaten their survival. However, at least some social inequalities, such as the discrimination against women in patriarchal systems, have continued for millennia, and thus seem to be stubbornly resistant to change, to say the least. This persistence might be connected with that the fact that, unlike our current unsustainable exploitation of the environment, social exploitation tends not to be characterised by exponential growth and thus does not as a rule harbour the same potential for sudden collapse. In any case, it might be argued that equitability should be treated as a separate problem from environmental sustainability, even if there are fundamental similarities in the worldview that leads to the mistreatment of nature on the one hand and that of certain social groups on the other. For this reason, and in order to place a separate emphasis on the social dimension of the wine industry, we distinguish equitability from sustainability, both in our motto and in our company philosophy.

It is at first glance surprising that many wine producers and resellers trumpet their commitment to product quality, excellence of service, and even environmental standards, but very few, and almost none of the most successful among them, address the question of equitability. However, if we examine more closely the structure of the wine industry, and specifically consider its elite actors, this silence becomes less mysterious. The most exclusive estates produce prestige wines that are sold with astronomical margins, sometimes from the winemaker to resellers, sometimes from resellers to consumers, sometimes both. Wealthy consumers have become accustomed to paying up to several hundred euros for a single bottle of wine. What many of them do not realise, or perhaps do not care about, is that their ability to pay such prices encourages greed and a proliferation of profiteers in the sales chain, furthers speculation in wine as an investment object rather than its enjoyment as a beverage, and takes the product out of the reach of less wealthy consumers. In this way, not only money but also quality becomes concentrated in a few hands. Furthermore, less and less of the wine itself is consumed, because its investment value transforms it into a financial product. Perverted from its original purpose, it ends up in “wine vaults”, perhaps never to be uncorked and enjoyed.

In this respect, elite producers are to a certain extent victims of their own success. They have limited control over the final market price of their wines, and nor is it their fault that the ability of their product to increase in both rarity and quality with age makes it so appealing to investors. Nevertheless, they are complicit in this situation as long as they are willing to benefit disproportionately from it. Let us be clear: a producer of biodynamic wines who makes and retains hundreds of thousands or even millions in profits every year is anything but socially responsible or, for that matter, environmentally sustainable. Prestige producers and the resellers who play this game contribute to the concentration of wealth and quality in ever fewer hands and to the reduction of their product to a dead asset. Furthermore, as noted in the previous text on quality, they place themselves in an ethically problematic position with regard to the source of their customers’ wealth. The margins that they charge on exclusive wines can only be realised in a global economy that systematically distributes economic surpluses, themselves the product of environmentally and socially unsustainable practices, to a small group of privileged economic agents. Wine critics go into raptures over the investments in quality at the most famous domains, and star architects are commissioned to design and build new cellars and visitor centres, but nobody asks how the financial surpluses that allow these investments were created. In other words, global economic inequality and environmental degradation are the foundations for the financial success of the elite wine industry.

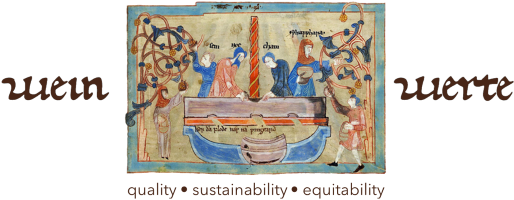

As if this were not enough, the wine industry as a whole pays too little attention to the health and social costs of alcohol. Wine is undoubtedly a cultural good, as described in our text on quality. However, like all alcoholic beverages, wine has a dark side. Wine producers and resellers should acknowledge this duality and work to minimise the negative impacts of alcohol consumption. This sense of responsibility is expressed in our logo, an image from a medieval English manuscript (British Library MS Cotton Claudius B IV folio 17r) that depicts Noah pressing grapes with his family.

Source: British Library MS Cotton Claudius B IV f.17r. © British Library Board

This image, quite apart from its artistic interest, is a reminder of both the millennia-long history of natural winemaking and the tightly-knit social context in which the production of wine traditionally took place. However, the story of Noah also points to the way in which the consumption of alcohol can lead to psychological and physical harm. According to the Bible, after the Flood Noah became a farmer and a vintner:

And Noah began to be an husbandman, and he planted a vineyard. (Genesis 9:20)

Noah is in fact the first winemaker in the Judeo-Christian tradition, and wine was indeed the main alcoholic drink in ancient Israel. The Bible contains numerous references to the positive value of wine, for example in Psalm 104, where God is praised as the source of “wine that maketh glad the heart of man”, or in 1 Timothy 5:23, where Paul prescribes wine for medicinal purposes: “use a little wine for thy stomach’s sake and thine often infirmities”. In addition, wine obviously has a spiritual character in both Jewish and Christian rituals, for example as Christ’s blood in the Eucharist. However, Noah was also famously the first drunkard, and he provides the first example of domestic discord associated with alcohol:

21 and he drank of the wine, and was drunken; and he was uncovered within his tent. 22And Ham, the father of Canaan, saw the nakedness of his father, and told his two brethren without. 23And Shem and Japheth took a garment, and laid it upon both their shoulders, and went backward, and covered the nakedness of their father; and their faces were backward, and they saw not their father’s nakedness. 24And Noah awoke from his wine, and knew what his younger son had done unto him. 25And he said, Cursed be Canaan; a servant of servants shall he be unto his brethren. (Genesis 9:21-25)

The story of Noah thus points to both the benefits and risks of wine. On the one hand, wine connects Noah to the land that was restored after the flood, and therefore also to God’s promise, symbolised by the rainbow, that humans would never again be wiped from the face of the earth. This sacred aspect extends for Christians to the New Covenant expressed in Jesus’s description of wine as his blood, shed for the redemption of humanity, and it is also present in numerous Jewish rituals involving wine, such as Kiddush, Havdalah, and Passover. It is even expressed in modern, secular contexts such as Luigi Veronelli’s description of wine as il canto della terra verso il cielo (the song of the earth to the heavens), which echoes Pablo Neruda’s cántico del fruto, discussed in the previous text on quality. The numinous aspect of wine thus continues to inform wine culture, and it is one way of understanding the idea of connectivity in the wine culture that we seek to promote. On the other hand, Noah’s drunkenness, shaming and the curse he places on Canaan associate alcohol with alienation and violence. It therefore acts as a cautionary tale, and its warning is as relevant today as the antithetical affirmation of wine’s positive dimension.

The figure of Noah thus reminds us of the ability of wine both to increase and decrease human well-being, and of the consequent need to treat wine responsibly, whether as consumers, retailers, or producers. This sense of responsibility is an ethical imperative, but for wine merchants it is also a strategic requirement, as the negative health and social impacts of alcohol are rightly attracting an increasing amount of attention from both consumers and regulators. It is therefore not enough for producers and resellers to concentrate on the shared pleasure of wine and ignore its victims, as an individual consumer like Jorge Luís Borges can do in his poem Al Vino:

Que otros en tu Leteo beban un triste olvido;

yo busco en ti las fiestas del fervor compartido.

Let others drink sad oblivion in your Lethe

I look to you for festivals of shared fervour.

On the contrary, the wine industry needs to recognise the negative impacts that its product causes in the whole of society, work with its various stakeholders to reduce them, and communicate its efforts to the wider public.

Our current wine culture thus tends to suppress both its social and environmental costs, but not only the producers and sellers of prestige wines benefit from unfair practices. The agricultural, logistics, and retail sectors, which are the primary employers in the wine value chain, have large numbers of low-qualified workers on their payrolls, some of whom are especially vulnerable immigrant or itinerant labourers, and most of whom have very little power to influence their working conditions and remuneration. This situation facilitates the exploitation of workers by unscrupulous or themselves financially precarious employers, which then compromises the ethical integrity of the wine industry as a whole. Regulatory institutions obviously seek to limit such abuses, but the mere existence of a minimum wage or legally prescribed working conditions is no guarantee that these rights will be respected, as is shown by the shocking revelations of the trafficking of harvest workers in the Champagne region.

There is thus a huge amount of work to be done with regard to the elaboration of ethically grounded standards of equitability, the implementation of such standards, and the transparent communication of equitability policies and measures. As such, it is almost impossible at this point for any producer or reseller to make a commitment to only work with partners who operate in a verifiably equitable manner. However, it is possible to set out a manifesto for the development of standards of equitability in the wine industry, and individual organisations such as our own can report on their contribution to this project. Such a manifesto might look something like the following:

1. Producers and resellers should apply no more and no less than a responsible margin to their products, one that neither exploits imbalances in the global economy nor unfairly undermines through price dumping the ability of other producers and resellers to earn a living from their activities. Producers and resellers should thus reflect critically on the value that they extract from the value chain, and then seek to ensure a fair distribution of this value to all actors. Furthermore, they should reflect on the equitability of the whole chain in relation to its broader socio-economic context and contribute to the elimination of unfair social inequalities through donations or other investments in projects that increase the level of local and/or global social justice.

2. All companies in the wine industry should adhere to both the letter and the spirit of the legal frameworks governing the industry, including tax liability, employee well-being, and remuneration. Where the national legal obligations are less stringent than generally accepted international standards, companies should follow the latter. Where the minimum wage that companies are required to pay is not a living wage, they should pay the latter.

3. Above and beyond their commitment to objective employment standards, employers in the wine industry should place the physical and psychological well-being of their employees at the centre of their organisational philosophy. In the spirit of connectivity, they should also follow an inclusive human resources policy and actively work towards increasing inclusivity in society as a whole.

4. Producers and resellers should seek to work as far as possible with partners committed to the principle of equitability, and they should promote the development and implementation of equitability standards throughout the industry.

5. Producers should seek to continuously improve the quality to cost ratio of their products, and together with resellers should work towards optimizing resource and cost efficiency in the value chain, as far as this is compatible with the principles stated above, in order to provide end-consumers with the best possible quality to price ratio and to release resources for the production of other social and environmental benefits.

6. Producers and resellers should inform themselves about the risks of alcohol consumption, inform and warn consumers of these risks, and encourage their customers to drink responsibly through both their communication activities and the provision, where possible, of an attractive offer of non-alcoholic beverages.

7. Producers and resellers should communicate their equitability policies and the results of their efforts towards realizing them in a regular and transparent manner.

Our equitability commitment

Like most organizations in the wine industry, we are only at the beginning of our equitability journey. However, we can set out our initial goals and the specific measures that we are taking with regard to the seven principles described above:

1. Our margins are calculated to provide a reasonable return on our investment of human resources. They are competitive, as those of a purely online retailer must be, but not aggressively low. We believe that a healthy amount of market competition is an important driver of both quality and resource efficiency.

Our pricing policy is one way in which we strive towards a fair distribution of the value created in the product supply chain. In addition, we seek to create long-term relationships with all our partners, and we rely on the strength of this relationship and of our shared principles to create a fair distribution of the benefits of our business interactions. We strive to provide our customers with the best possible quality to price ratio without compromising our agreements with and responsibilities towards other actors in the value chain.

2. and 3. We are committed to full compliance with legal standards, and we voluntarily publish financial data of our company on our website. We currently have no employees, but as soon as we do, we will establish policies to ensure their loyalty and engagement by providing them with fair remuneration and a working environment in which they are both physically safe and able to gain personal and social fulfilment. We explicitly support inclusive employment policies and the principles of inclusion and diversity on the level of society as a whole. We are committed to reporting on the practical measures that we take to demonstrate this commitment.

4. We are in the process of developing an equitability checklist and a self-declaration form for our partners. We will publish our form on this website, and we will encourage our partners to publish their forms on theirs and/or on ours.

5. We are constantly seeking to make our processes more efficient, but without compromising any of our equitability commitments. We also pass on suggestions to our partners for more quality and more efficiency in the services and/or products with which they provide us. A further feedback loop runs through our customers, and we value their suggestions and recommendations very highly. In this way we hope to ensure both the long-term competitiveness of our company and the satisfaction of our partners and customers.

6. We see the promotion of responsible alcohol consumption as an essential aspect of our equitability efforts, and we currently take the following steps to ensure that this commitment is sufficiently implemented in our company:

- We comply with all legal requirements regarding age restrictions and health warnings. We also go beyond these requirements by indicating units of alcohol and approximate calorie counts wherever possible for the wines in our online shop, and we communicate responsible levels of consumption on our website and in our online shop. With regard to levels of consumption, we follow the current recommendation of the Swiss and German ministries of health of not more than two standard drinks per day for men, and not more than one standard drink per day for women, as well as the German recommendation to not drink any alcohol on at least two days per week. We define a standard drink as 10g of pure alcohol, which for a wine with 13.5% alcohol equates to 74ml of wine. The Swiss and German governments define a standard drink as 10-12g of alcohol. We have adopted the lower point of this range. We also warn our customers not to consume alcohol when pregnant and not to drive or operate machinery after drinking.

- We are a member of Wine in Moderation, a social responsibility programme launched in 2008 by the European wine sector to reduce harm and promote moderation in connection with wine consumption.

- We contribute 1% of our 1% of our Swiss wine revenues to Sucht Schweiz and 1% of all other wine revenues to Keine Macht den Drogen. Both organisations focus on addiction prevention. This might seem like a small amount, but a study conducted by the University of Neuchatel came to the conclusion that every 1 CHF invested in the prevention of alcohol addiction saves 23 CHF in later damage. This points to both the necessity of such support and the effectiveness of even small contributions.

- We voluntarily apply a minimum price per unit of alcohol policy in line with the Irish regulation (the only one in the EU at this point in time) of one Euro per unit of 11g of alcohol. This means that a wine with 13.5% alcohol will cost at least € 10.10 incl. VAT per 750ml bottle. This might not seem very expensive, but it should be kept in mind that the average price paid for a bottle of wine in retail outlets in Germany in 2019 was € 2.34 incl. VAT, a price which is not sustainable by any measure, whether economic, social, or environmental.

- We discourage excessive consumption by offering single-bottle purchases, no quantity discounts, and as few special offers as possible. We encourage our customers to choose quality over quantity. We also plan to introduce small format tasting packs, so that customers can enjoy a variety of wines without overconsuming.

- We encourage our customers on our website to consume wine in company and with food, and we further promote this culture by organizing wine and food tastings.

- We are working on extending our product range to include non-alcoholic beverages. We are especially interested in promoting the consumption of high-quality tea as an alternative to wine.

7. This text sets out our equitability policies and the measures currently in place to fulfil them. On our home page we publish a list of key social and environmental performance indicators. These show how much we invested in social and environmental projects in the previous financial year and the ratio of these investments to sales. Certificates and other proofs of our engagement are also published on our website as soon as we receive them. We are therefore committed to maximum transparency.